-

DG Shipping serves notice to remove grounded vessel Nu-Shi Nalin near Goa

07 November, 2019 | Snippets

07 November, 2019 | Snippets -

Yacht placed ‘under arrest’ at boat show over $4 million dispute

06 November, 2019 | Snippets

06 November, 2019 | Snippets -

Philippine SC to appoint Admiralty courts for shipping cases

06 November, 2019 | Snippets

06 November, 2019 | Snippets -

Availability of Audio Recordings of Singapore High Court Trials

06 November, 2019 | Snippets

06 November, 2019 | Snippets -

Panama Canal, AMP Upgrade Maritime Single Window

04 November, 2019 | Snippets

04 November, 2019 | Snippets -

TOTAL joins Adani to create India’s premier integrated gas utility

14 October, 2019 | Snippets

14 October, 2019 | Snippets -

Chemical Tanker Arrest in Singapore

12 September, 2019 | Snippets

12 September, 2019 | Snippets -

Tanker Crews in Risk of Being Arrested off Libya says Gard

10 September, 2019 | Snippets

10 September, 2019 | Snippets -

The King is dead. Senior Advocate Mr. S. Venkiteshwaran passes away

23 December, 2013 | Snippets | Read Full Post »

23 December, 2013 | Snippets | Read Full Post » -

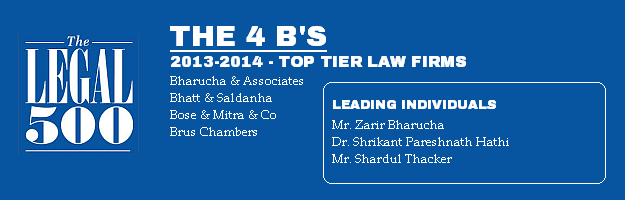

4 B's, ranked by Legal500 as Top Tier Shipping law firms in India

-

m.t. Maharshi Vamadeva arrested at New Mangalore for unpaid wages

-

Five other seafarers also initiates legal action against m.t. Maharshi Vishwamitra, ship ordered to be arrested at Sikka by the Bombay High Court

-

Trailing suction hopper dredger KAMAL XXXV auction sold by Bombay High Court

-

Chief Engineer of tanker vessel m.t. Amba Bhavanee gets order of arrest of vessel m.t. Maharshi Vishwamitra at Sikka from the Bombay High Court

-

Indian motor tanker vessel Desh Shanti released by Iranian Revolutionary Guard Corps (IRGC)

-

Ocean Sparkle Limited initiates admiralty action against vessel m.v Eastern View in the Bombay High Court

-

Vessel m.v. Lily Noble sold for scrap, arrested by Bombay High Court

-

m.t Pratibha Neera auction sold by Admiralty Court to Baltanas Shipping for INR 19.75 crore

-

Gujarat High Court orders arrest of vessel m.v. Meem in light that the vessel is at Gujarat State waters, Bhavnagar Alang, within the sea jurisdiction of Gujarat Court

-

Admiralty Judge forwards order to the Chief Justice as Dy. Sheriff of Mumbai is busy with his own work and not available most of the time

-

Cargo of Steam Coal laden on m.v. Spar Capella arrested

-

S. Venkiteshwaran sets up Committee Maritime India (CM-I)

-

Han Hui vessel owner settles disputes with KTB Oil Corporation, vessel released as settled

-

MSC Clementre sistership of MSC Nilgun arrested at Mundra, as vessel jumps arrest at JNPT port

-

Bombay High Court Admiralty Judge confirms auction sale of Pratibha Indrayani and Pratibha Tapi

-

Vessel released, making any payment towards Sheriff's poundage does not arise: Bombay High Court

-

Vessel m.v. Se Pacifica ordered to be arrested by the Bombay High Court

-

Admiralty court allows to move arrested vessel from berth to anchorage

-

Vessel m.v. Meem once again ordered to be arrested by the Bombay High Court in another legal action

-

Vessel m.v. Han Hui ordered to be arrested by the Bombay High Court jumps arrest at Mumbai Port arrested at Mundra

-

Tanker vessel Chemical Arrow released from arrest by the Bombay High Court as vessel sold by the Madras High Court

-

Indian flag vessel Tuhina at Visakhapatnam arrested by the Bombay High Court

-

Vessel m.v. Meem heading towards Alang ship breaking yard at Gujarat was arrested by the Bombay High Court, the owner of the vessel was heard by the Admiralty judge

-

Two admiralty action against the vessel m.v. Theraps in the Bombay High Court withdrawn as settled

-

M.T. Pratibha Neera timeline for auction sale of the vessel scheduled by the Bombay High Court, reserve bid fixed at INR 23 crores,

-

..............................................................................................................................................

This Page is contributed and reviewed by our Research Team

- WLSA,I: 3102-8051

- shiparrest.co.in is an initiative by SALK, in association with Shippinglawyers.NET

- ..............................................................................................................................................

- The content of this page nor any part of this page or content from any page or part of the same from this website should not be construed as legal advice, you are therefore requested to verify the same from your source. The information provided in the entire site is of general nature and may not apply to any particular set of facts or circumstances. Browsing shiparrest.co.in would mean that you have accepted our terms and conditions for browsing and the disclaimer.

.